Helium Inc., the company behind the Helium Network, is renamed to Nova Labs.

Did they need some fresh money?

This said it all and still holds true! #384 LoraWAN + Cryptocurrency Miner = Helium. A good idea? - YouTube

I am coming from the helium side. I was running my DIY gateway. I moved it recently to TTN, which I am using as a hobbyist.

In theory, the PoC and incentivized decentralized networks are fine, but transactional-based blockchain mining may not be the best way to do so.

I believe Helium HIP-70, the new proposal from Helium, is ditching the decentralization to keep the incentive; all the PoC and data packets accounting is moving to Oracles, and oracles are just centralized servers. Helium will no longer develop blockchain, instead running smart contracts over Solana Blockchain for accounting and registration.

This money-oriented incentivized model mainly brings more constraints than flexibility.

Bitcoin is a money transfer service. It incentive people with bitcoin. The incentives may make more sense if they directly benefit the gateway runner or node runner from what the network offers. In the case of the LORA IoT network, people’s incentive to run their gateway is a free traffic and stable coverage.

I think this just another example of the whole ‘problem’ with Helium - apart from having to radically restructure to accommodate shortfalls & gaming of a system that is largely built on the quick-sand of notional money - the jargon & practical implementation is almost impossible to understand.

The original TTN model was simple and pure but, like almost everything like that in human history, has been taken advantage of by a minority who use the network resources disproportionately to their own commercial gain, at the expense of the majority.

So in making comparisons, it would be interesting to come up with a workable model.

It has become evident that the majority of gateway deployments are primarily for the benefit of its owner (community or commercial) who need the coverage - and as they get some side benefit from the coverage of other gateways, are inclined towards sharing their gateway on a quid pro quo basis.

It is acknowledged that there are a few totally altruistic deployments from our happy band of benevolent fanatics and those who took the leap of faith by buying a relatively expensive gateway during the bootstrapping phase. However gateways are now relatively affordable in the context of benefit accrued, so there is now little excess capital cost donated to the community network.

In a similar vein, the backhaul costs are typically negligible, leveraging existing infrastructure. For those who need to use a mobile connection there are some considerations about the recurring costs of a data plan and the proportion of own & community traffic.

Devices are deployed almost entirely for own use so any costs involved aren’t relevant to this, but see below for a sharing model.

The primary costs are in the running of an LNS. Relatively speaking, standing data is cheap to store but for the LNS to be responsive, some of the device data has be to kept in memory for instant use, even if the device only transmits once a year or indeed, never. This memory comes with a cost. There also needs to be sufficient processing power to run day to day requirements and have enough spare to cope with a reasonable unexpected surge in throughput.

I’d conclude that the most equitable funding is a small standing cost per device and a cost per uplink & downlink. It may be appropriate to credit the gateway owners a small percentage of the uplink charge, spread proportionally over the gateways that hear the uplink - as that would reduce the incentive to put a gateway in a high-traffic area that already has good coverage. Downlinks and ack’d uplinks should cost more.

A potential extension of running an accounting system may be selling data such that if an area has sensor coverage, a separate part of the stack could manage the publishing of data feeds for purchase. If someone is already collected data it makes no economic or environmental sense to deploy your own sensors. An audit mechanism of locating some verification sensors in the vicinity of the original deployment could be provided for QA.

Who you calling a ‘fanatic’?! ![]()

![]()

…its “evalgelists”, dear boy! or possibly “sponsors” ![]()

![]()

![]()

Fanatic = “a person with an obsessive interest in and enthusiasm for a particular activity”

Evangelist = “a person who seeks to convert others to the Christian faith, especially by public preaching”

Sponsor = “a person or organisation that pays for or contributes to the costs involved in staging a sporting or artistic event in return for advertising”

You choose!

Enthousiast sounds good to me. The other options don’t feel comfortable. But I’m not in Jeff’s league of gateway deployments.

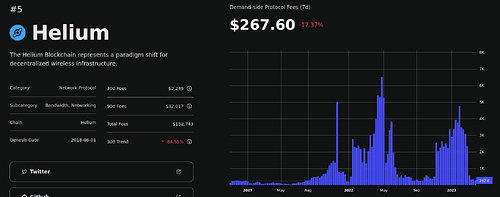

Beyond issues with its miners and token system, Helium appears to have a more pressing problem: The company seems to be struggling to generate revenue from its network. Forbes found that over the past year, between June 2021 and August 2022, just $92,000 in revenue was generated from data moving across the network, according to Helium’s own numbers — a figure that starkly contrasts the $250 million the parent company has raised from investors. Instead, Helium generates the vast majority of its revenue — $53.3 million during the same time period — from people registering their new hotspots and authenticating other devices on the network.

…

The crypto landscape is “littered with the bones of projects that have basically fallen by the wayside because the ultimate promise is not being met by fundamental economics returns,” Monsur Hussain, head of Financial Institutions Research at Fitch Ratings, told Forbes. For Helium’s network to become profitable, Hussain added, “You’d actually need to have the whole earth covered in a few feet of these devices to potentially consume enough data.”

I am really glad this conversation is still on ongoing as there is a lot to learn from the successes and failures of Helium and from investigating our biases and principles.

I still think it would be important for any communication network is to allow the users to assign a greater than zero economic value for the utility of the service and pay the gateway provider accordingly. The fundamental economic incentives and mechanisms have got humanity so far and most likely could benefit TTN when implemented correctly.

Blockchain seems the latest computer science solution to the problem but ultimately it is just a tool and can be used various ways. Helium has been an attempt to utilize and benefit from this technology however their priorities seem to have shifted to where most other alt coins have been converging as well.

Bitcoin with the Proof-of-Work system has been the pioneer of this technology while all the alt coins have moved to the contrarian federated Proof-of-Stake securities including Helium with its Proof-of-Coverage network.

Do you think that the utility and the potential for Proof-of-Work in communication networks continues to exist?

Do you think focusing more on Proof-of-Transmission and abandoning the game of staking and federations would follow first principles?

Rumor says you’ve just left that position?

At that height they’d get phenomenal proof-of-coverage …

Many people try the same peaks/approx locations - so good P.O.C then gets mitigated against by everyones Transmit Scale being dialed back due to congestion in the Hex’s and neighbourhood! ![]()

![]()

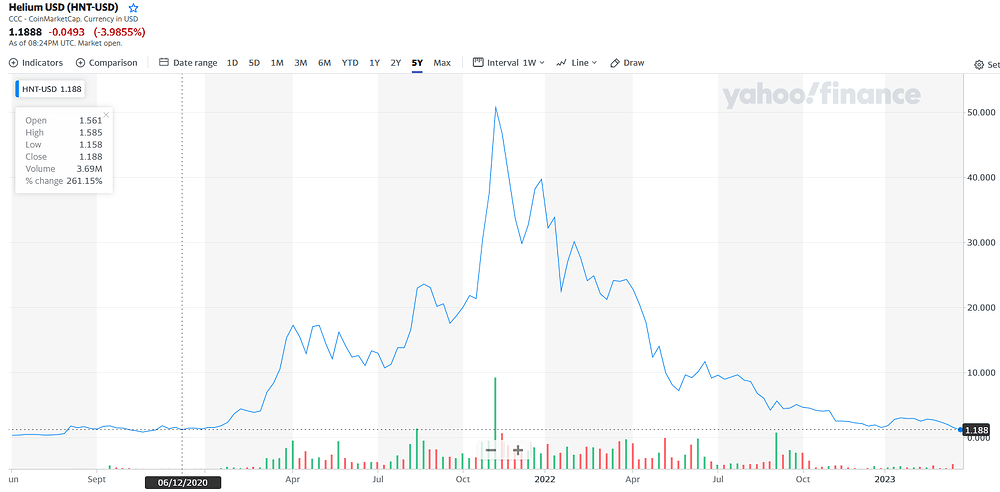

Get the impression that the Helium Balloon inflation/deflation cycle now all but complete. From initial 1HNT/$US we are now back below $1.20 at levels not seen since Q420 ![]()

I am running two nodes : one on thethingsnetwork and another on Helium.

What I like in Helium is that it is extremely heap (but not free as TheThingsNetwork) and that there are some rewards. In my neighborhood a lot of users have been trying Helium and you have to be quite competitive to earn some HNK : the station has to be installed at the right place outdoor. Some user stop using Helium and hotstops are resold and bought by other user who install station on the righ spot. This is a quite profiting value chain as the market adapts continuously.

To make it simple : around 1 million stations have been sold. On the long run they will be installed somewhere. So IMHO this is game over for other networks. The good news is that it should be possible to link TheThingsNetwork to Helium.

as you seem to be taking the long view, who do you think is going to be paying your ‘rewards’ when manufacturers stop buying HNT to commission new devices because demand has collapsed? are you counting on actual traffic at $0.00001 per 24 bytes? that’s not looking too good, volume 84% down over the last 31d…

of the 990,122 hotspots sold, more than 500,000 are offline today, and i can see 2 main reasons for that:

- many have been kicked off the network because they were spoofing their location (i.e. stealing your ‘rewards’), and they might back as soon as there is money to be made again

- other owners just unplugged because the ‘rewards’ were not worth it

The Helium bubble is just exploded (or is imploding) - what you want with a network with no pay-willing customers , a lot of cheaters and nearly no data traffic?

I have also a Helium & TTN gateway on one location - on TTN i have a small amount of real data traffic given - on Helium (except for 4 months until they changed their PoC process, ) i had a very small amount of frequent data traffic- but this was fake- there are simply no sensors deployed / connected at my location. In an Austrian , more rural location, i had 1 time in 11 months data traffic and then never ever anything -simply forget it . Helium is now rated by a lot of people to be a hardware selling scam project - and yes., they made their money by harvesting together with the miner producers the big margin for totaly overpriced hardware and also from the onboarding fee . This was IMO a functional , Madoff-like snowball principle…but now its over. Helium is loosing according their blockchain data day by day betwenn 400 - 1300 hotspot locations - this tendency is actually speeding up, because a direct competitor “Crankk” just started their Beta phase. And you see in the Helium discord some kind of panic, since Amazon was announcing their Lora based project . If the blockchain move to Solana will be a bumpy ride, then things will become interesting - the token value is actually knowing only one direction and if Nova /Helium F will mess it up, then the last persons (except the real , not so numerous fanatics) will loose any trust in this project

Addon: Helium founder races cars while the crypto startup is on collision course